Features and Recent Evolution of Corporate Debt in China

- Available Online: 2021-10-20

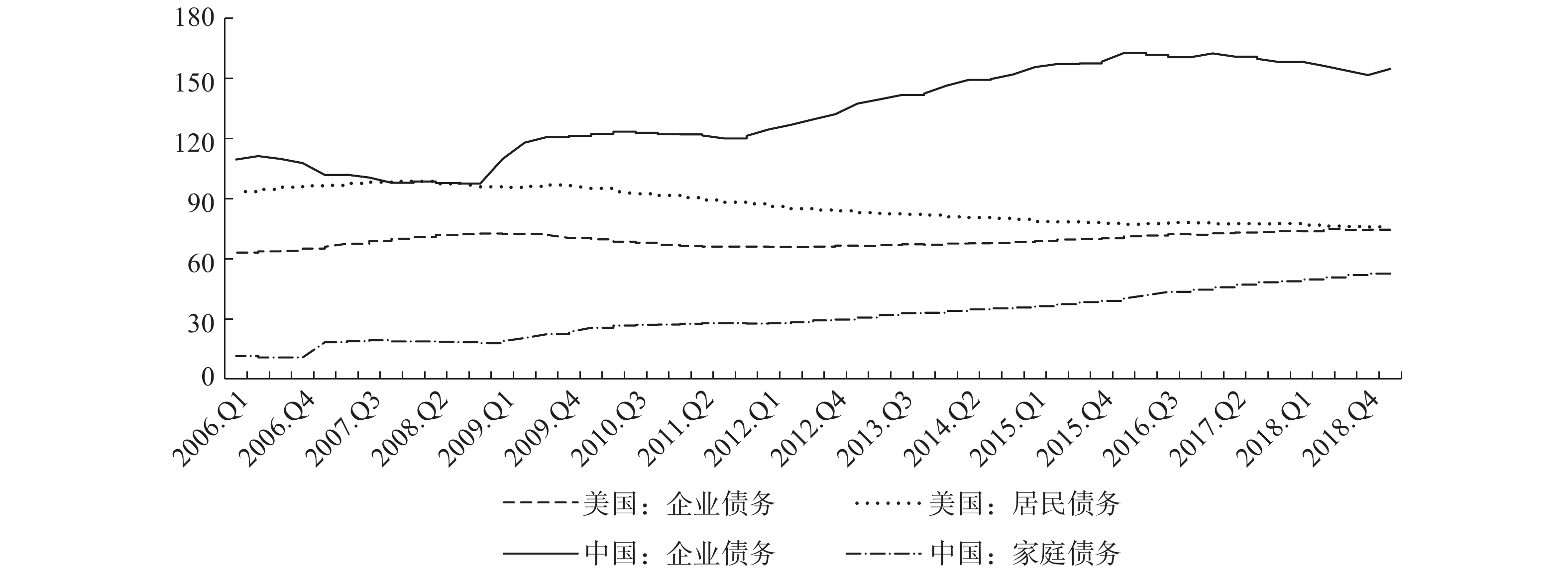

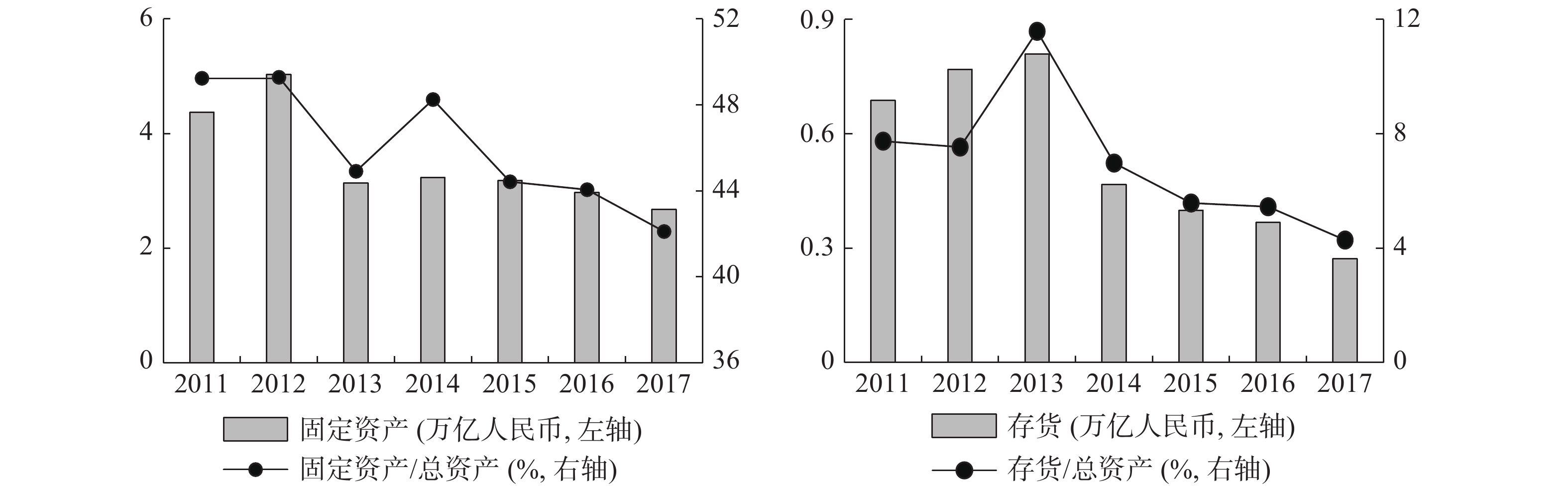

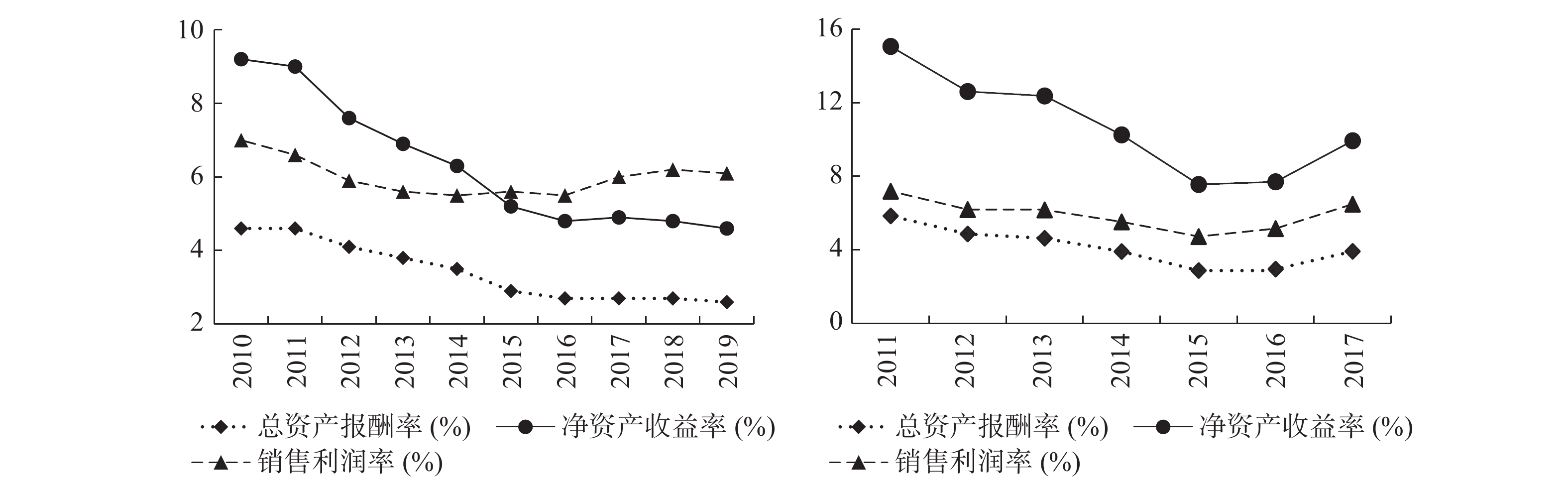

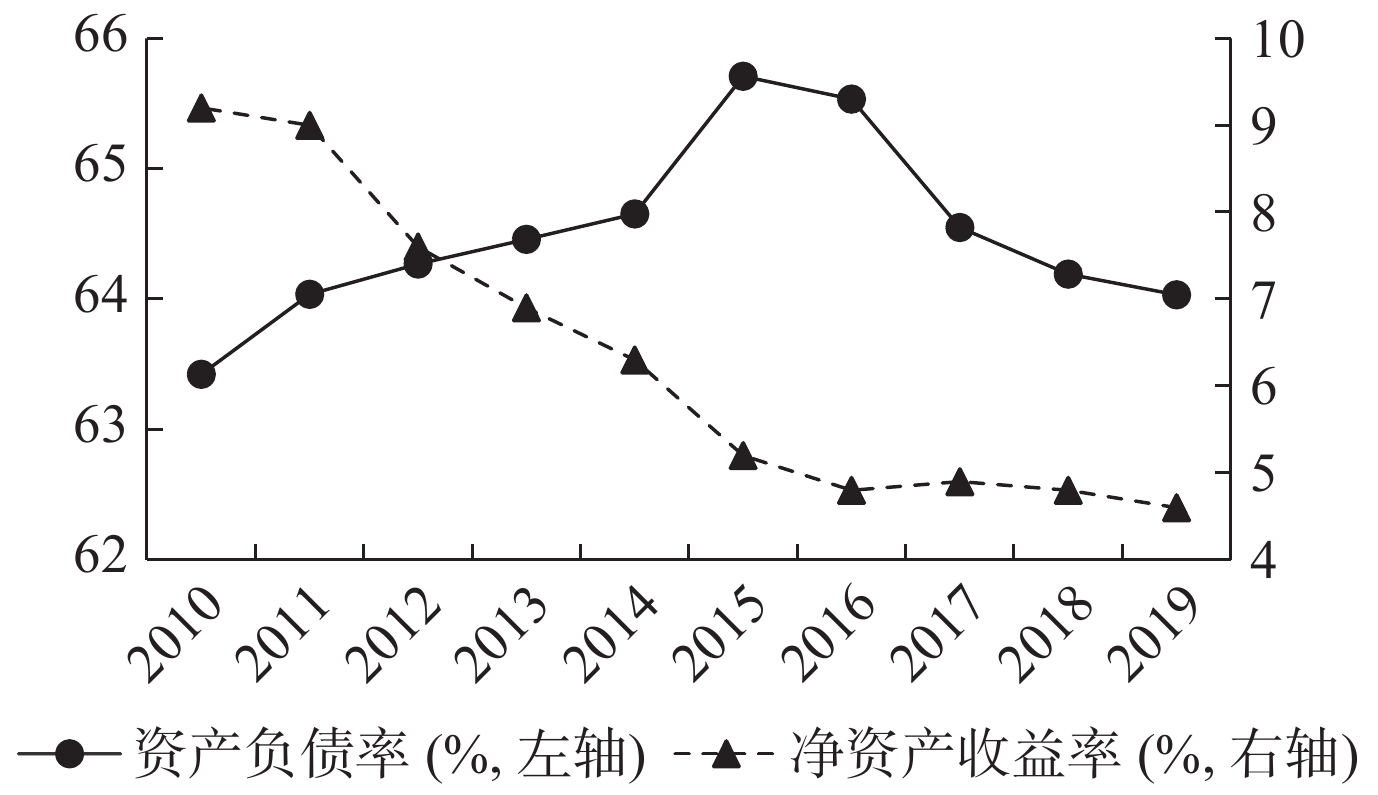

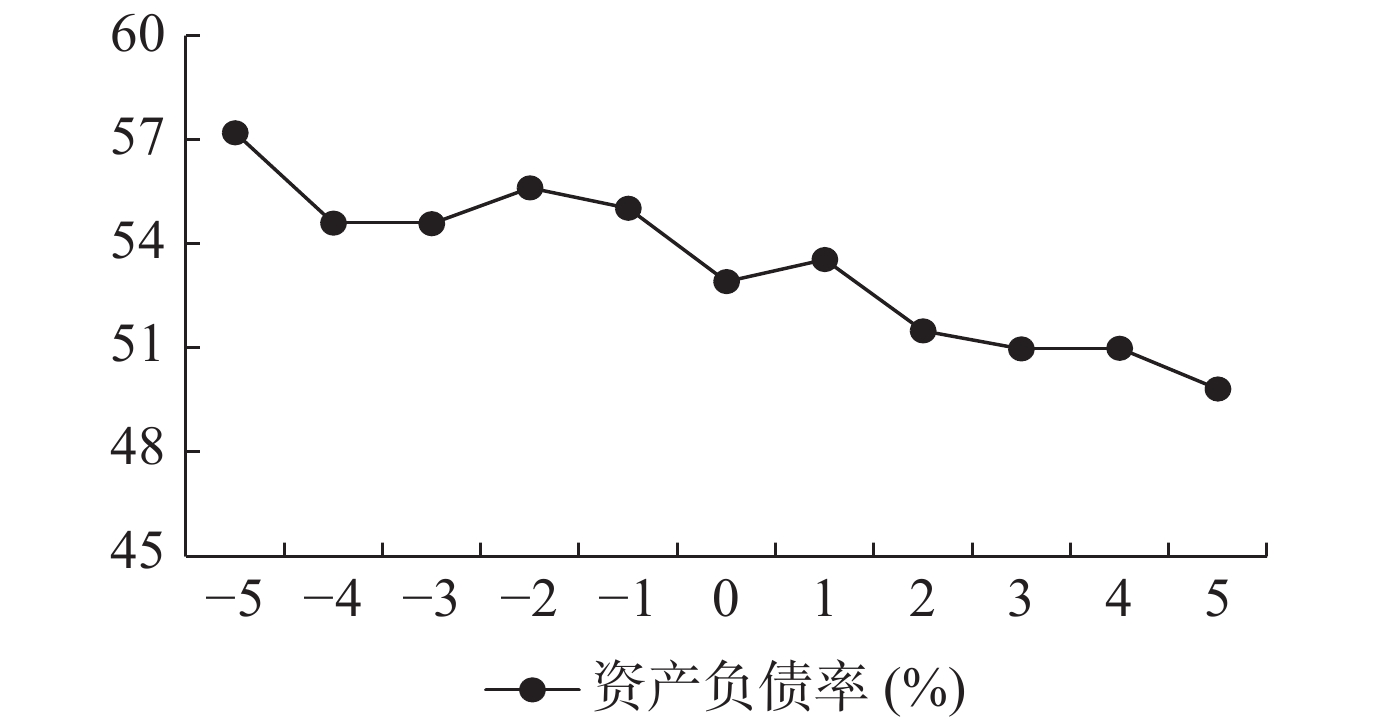

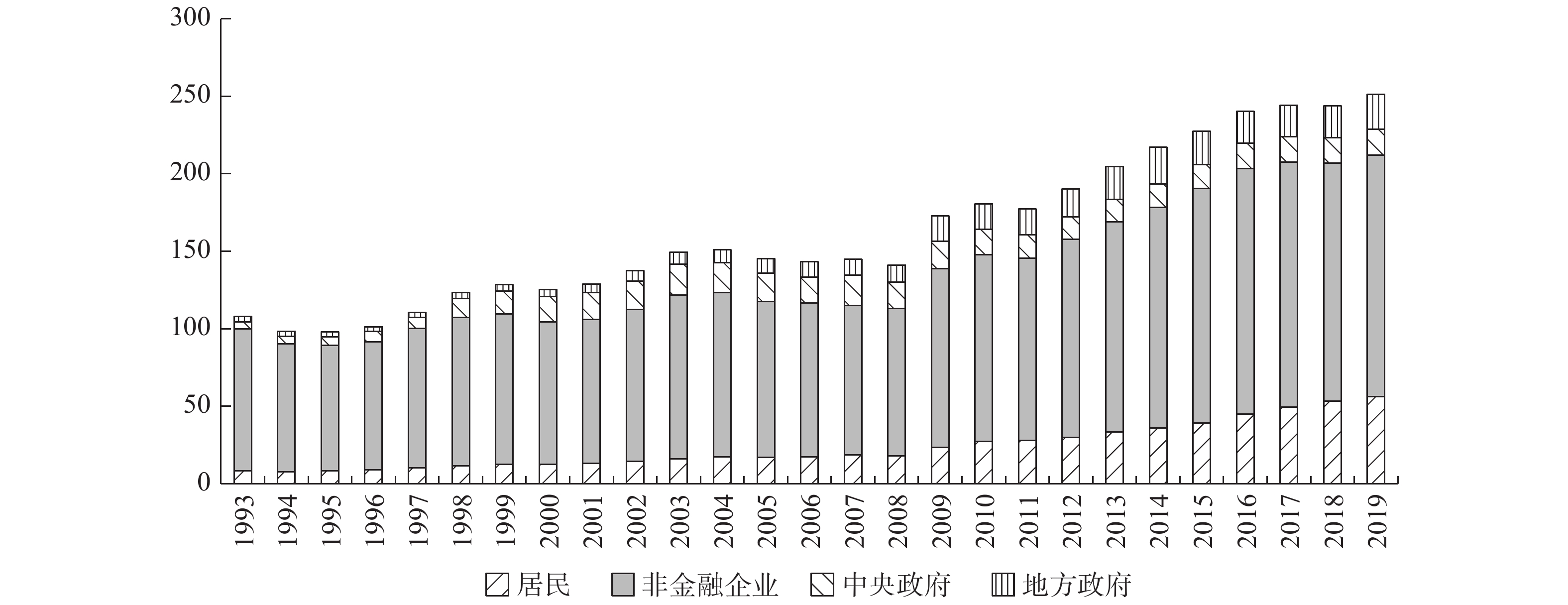

Abstract: This paper examines the important features and recent evolution of China’s corporate debt, paying particular attention to the impact of supply-side structural reforms and of COVID-19 on corporate debt. First, we find that the non-financial corporate sector is the main driver of the rapid rise in China’s total debt-to-GDP ratio since 2008, unlike the U. S., where the household sector borrows the most. More importantly, China’s corporate debt is found highly “structural”, due to its large concentration in a fraction of firms. What is worth noting is that the supply-side structural reforms implemented since 2015 have effectively reduced the debt ratios of SOEs and improved their performance. Meanwhile, the impact of COVID-19 on the deleveraging process in China appears limited. It is crucial to mitigate China’s corporate debt risks by deepening capital market reforms to increase the share of direct financing for enterprises and simultaneously accelerating SOE reforms.

沪公网安备 31010102003103号

沪公网安备 31010102003103号 DownLoad:

DownLoad: