The “Excessive” Expansion of Financial Industry: The Fact and Interpretation from China

- Available Online: 2021-10-20

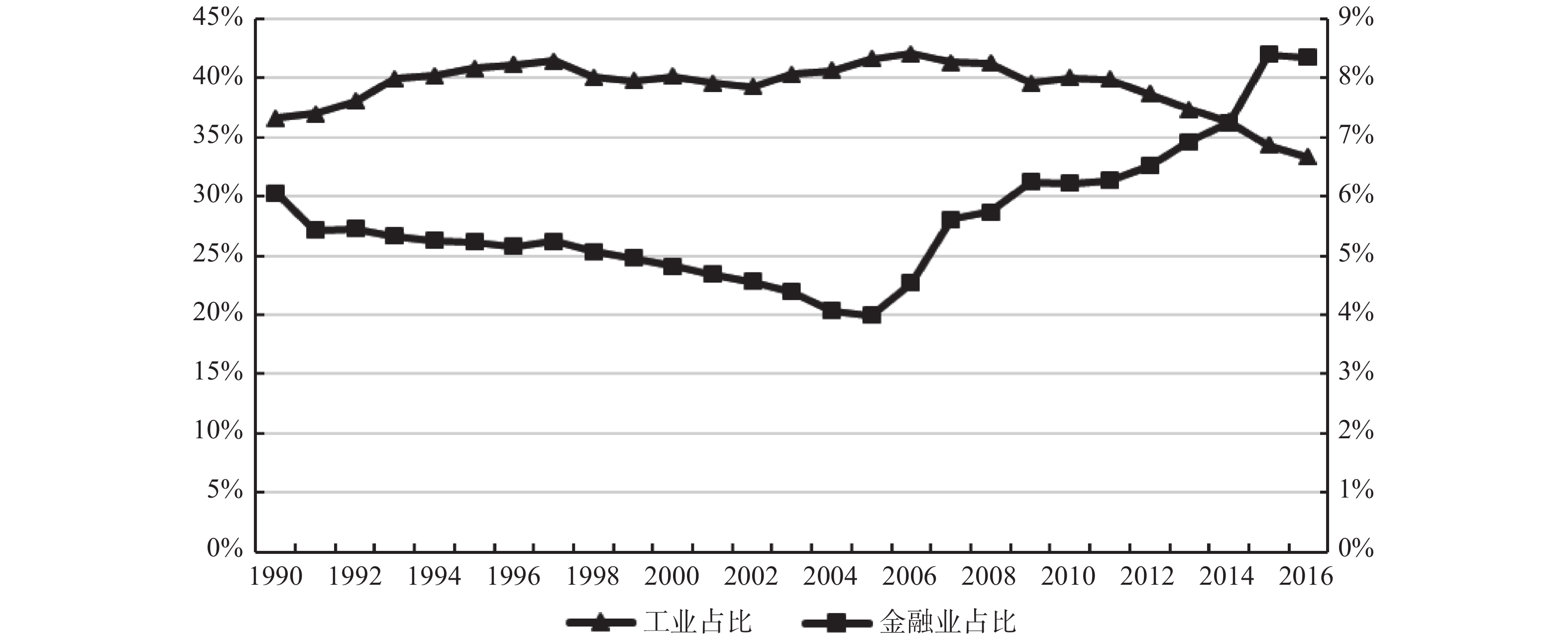

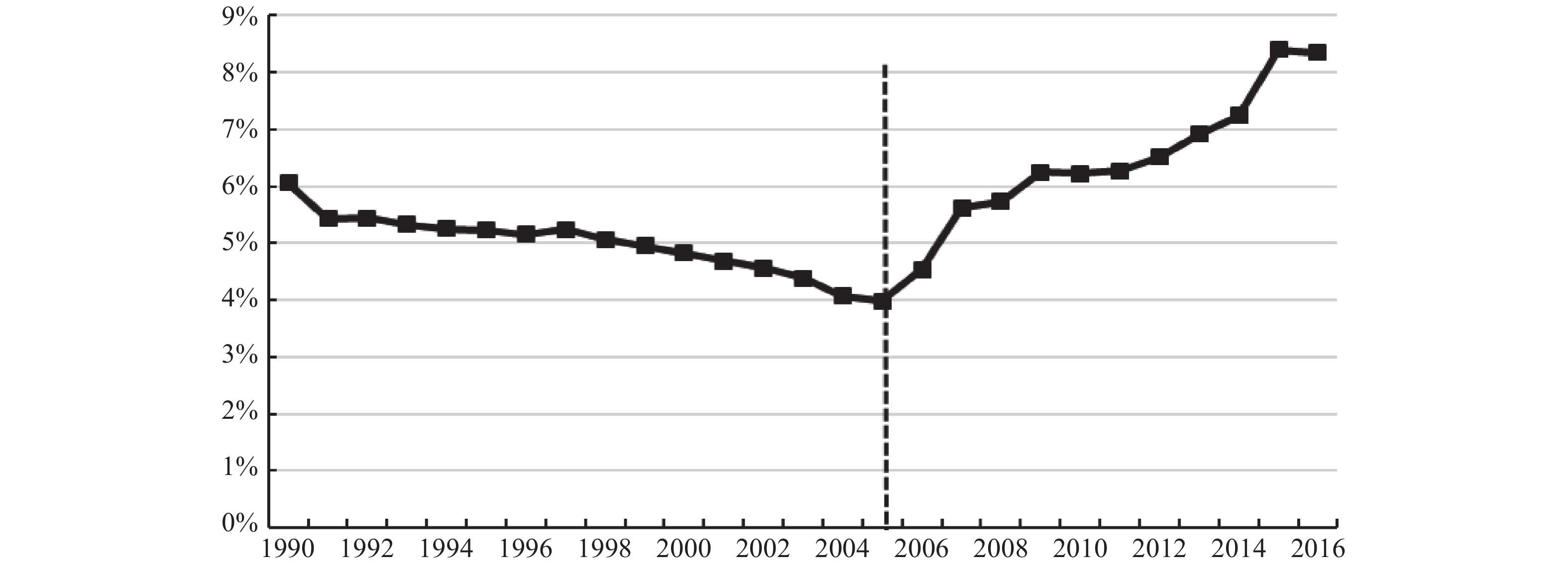

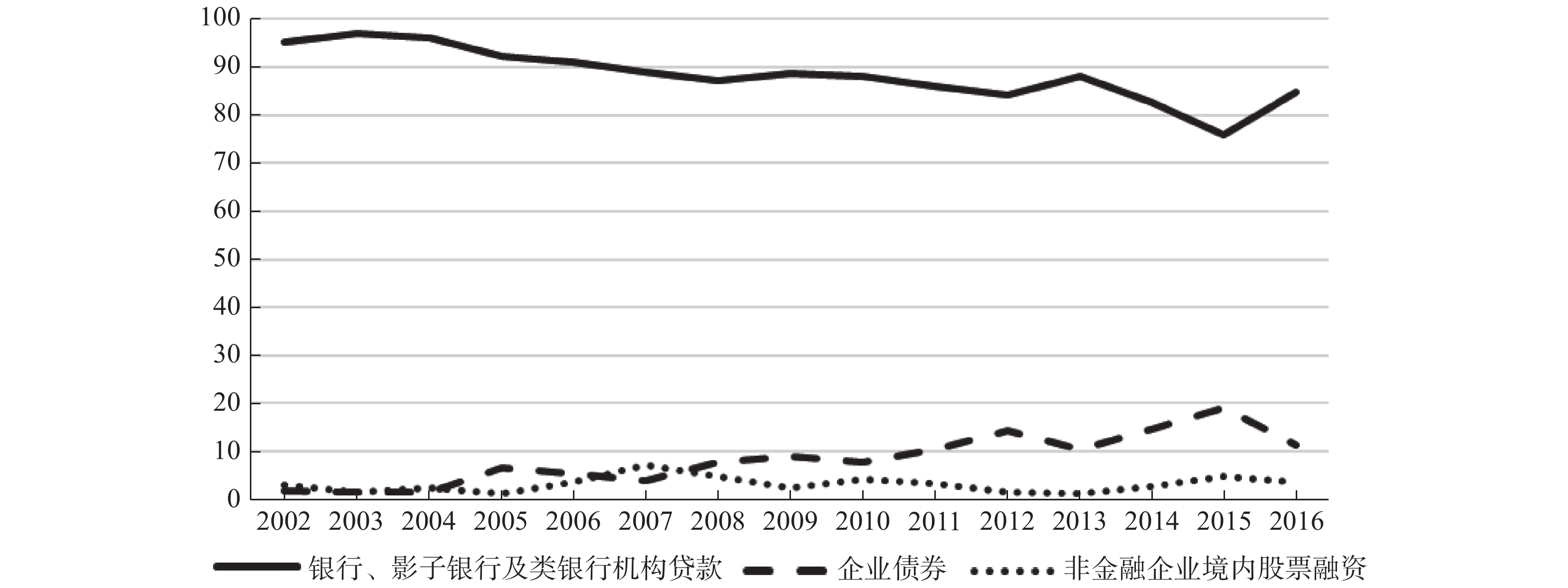

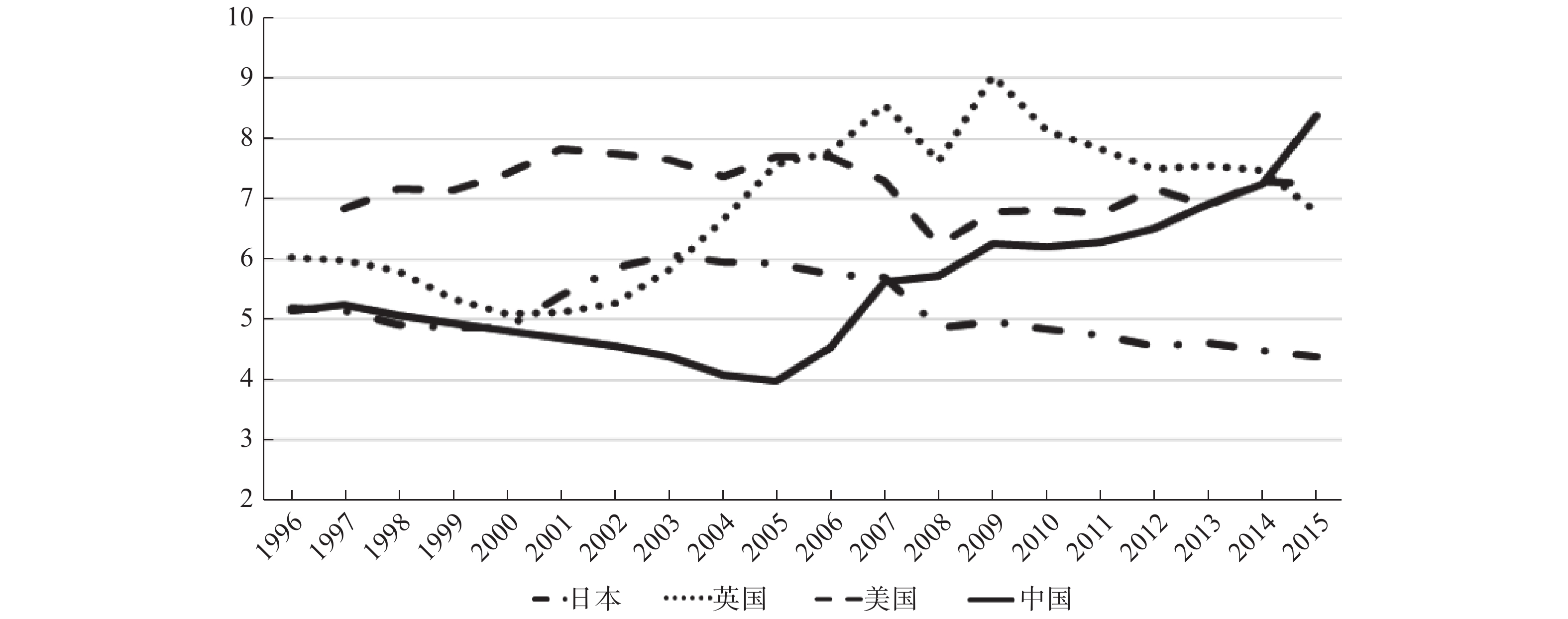

Abstract: The ratio of value added of financial industry to GDP shows the trend of rapid growth after the year 2005, and a typical phenomenon has emerged that the value of that ratio in China has surpassed those values in developed countries, such as US, UK, Japan, as so on. We conclud that phenomenon as the stylized fact of the “excessive” expansion of the financial industry. This paper examines the effect of the growth of the ratio value added of financial industry to GDP on the ratio of value added of industrial sector to GDP, by constructing relative instruments variables based on the foundation of identifying the policy shock effect of China’s successively promulgated deregulation of bank business and regulation relaxation policy on the scope of bank business and operation. The empirical results reveal that, the “excessive” expansion of the financial industry with Chinese background, has significant inhibitory effect on the development of the real economy mainly contributed by manufacturing sector, and the inhibitory effect is driven by the extrusion effect on fixed asset investment of industrial sector. The further findings show that, as for the inner motivations of “excessive” expansion of the financial industry, it may closely relate to the financial incentive of local government in favor of the development of financial industry since the expansion can bring the rapid GDP growth. It also has close connection to the incentive motivation of the increase of regional financial income caused by financial expansion. Meanwhile, it may relate to the incentive motivation that the expansion can strengthen the capability of local governments’ debt. A series of empirical findings in this paper, provide unique empirical evidence for deeply understanding the stylized fact, judgment basis and formation mechanism of “excessive” expansion of the financial industry in China, and provides necessary policy reference for the necessity and possible direction of the reform of China’s financial system.

沪公网安备 31010102003103号

沪公网安备 31010102003103号 DownLoad:

DownLoad: